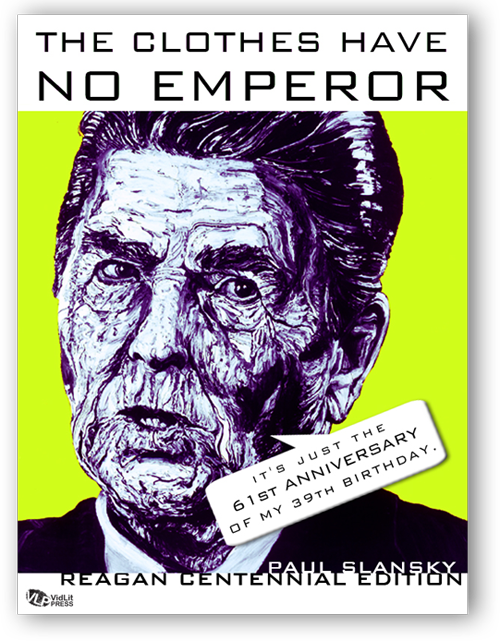

Yes, today is the 100th anniversary of the birth of Reaganism, the plague borne to us by that "grinning huckster for the avaricious," Ronald Wilson Reagan. There are deft debunkings of Reagan-the-myth all over the Web today. I offer this modest followup to my own obituary for Reaganism's earthly vessel. As I mentioned, my article on "Why the Right Hates America" generated a great deal of correspondence, some of which still trickles in. The email below was part of an exchange with one of the factually challenged interlocutors:

As Dutch himself said, "facts are stupid things." Republicans like to toss around the fact that Congressional spending outpaced Reagan's budget proposals by an average of $2.8 billion a year. That in itself is pretty trivial in the context of adding two trillion to the national debt (three trillion if you count the elected President Bush's term).

But this is a particularly stupid fact. Leave aside the fact that the Republicans controlled the Senate for six of Reagan's eight years in office. Leave aside the fact that he never once submitted a balanced budget to the Congress. Leave aside the fact that he could have vetoed any spending bill he thought was too profligate.

No, what's really stupid about this fact is that if the Congress had actually passed all eight of Reagan's budgets exactly as written, spending would have been even higher - by another 30 billion!

The reason this is true lies in the way budget proposals are written. In order to estimate non-discretionary spending (like unemployment insurance, welfare spending, cost-of-living increases, etc.) the OMB has to make certain assumptions. But Reagan's budget directors deliberately made completely unrealistic projections about what unemployment, inflation, growth, etc., would be. That way they could turn around and blame the Congress for spending more than Reagan had asked!

Which, of course, they're still doing.

But if Congress had passed Reagan's budgets, the growth rate would still have been the same, and entitlement spending would have reflected that either way. But in terms of discretionary spending, Reagan actually requested $30 billion more than Congress spent. Which, again, is only one percent of the three trillion in deficits caused by his tax bills and Pentagon spending spree, but it makes it pretty hard to blame Congress for overspending. Especially when Reagan's OMB director has publically admitted that they knew exactly what they were doing and produced those record deficits on purpose.

Ooops!

Now, I'm sure Rush or someone similar has told you that tax revenues went way up in the Reagan years because of the miracle of supply-side economics, and that only the Congressional overspending could account for the deficits.

But that's only true if you fail to account for inflation, which is an awfully popular way of lying with statistics. If you use constant dollars, you can see that tax revenues declined during his first term, thanks to his outrageous corporate giveaways which had hugely profitable companies paying negative taxes. Even Dutch himself recognized that that couldn't last. That's why he took Alan Greenspan's advice and signed the largest tax hike in history.

You heard me right.

In 1983 Reagan signed into law a massive, though gradual, increase in the payroll tax - ostensibly to build up a Social Security surplus for use when the Boomers start to retire in 2012. As we all know, or ought to, that surplus has been used ever since to pad the general fund and make the deficits look smaller than they actually are. That means, among other things, that we have a giant IOU to the SS trust fund which the appointed President Bush is making even worse.

But. most importantly, it means that Reagan signed a huge tax hike on working people to make up for his giant tax cuts for rich people. And, again, you have to use constant dollars to compare it to Clinton's 1993 tax hike in order to see that Reagan's was bigger. Of course, the payroll tax is hugely regressive, because it's capped at the first $87,000 of income. That means that if you, Mr. C, make more than 87 grand a year, you pay a smaller percentage of your income in payroll taxes than I do. And someone who makes 870 grand a year pays even less, proportionally.

The result is that 80 percent of the population - the bottom 80 percent - pays more in payroll taxes than they do in income taxes. So that tinkering with income tax rates, like the appointed President Bush did, makes a lot less difference to them than that huge increase from Uncle Ron. Let alone capital gains or estate taxes.

That's also why it's not too helpful to indignantly point out how much the very rich pay in income taxes. The top 1% may pay a bigger share of the total income tax take than in 1980, but that's because they also have a much bigger share of the national income. Their share of total tax revenues isn't nearly as big - and their after-tax income is considerably higher. Nice deal.

Now, if you want, you can still argue that deficits went up because Congress agreed to hike Pentagon spending but refused to cut social spending. Ooops, no you can't, because then you run into the six years of the GOP Senate and the stupid fact that Dutch never submitted a balanced budget himself. So I guess you're left to argue that deficits don't matter.

That's not what Republicans used to say - after all, Reagan ran for president condemning Jimmy Carter's deficits - but now that the GOP has run up the biggest deficits in history, once again, that seems to be the new party line.

Except that they do matter. Sure, it makes sense to run a deficit during a downturn, just like it makes sense to build up a rainy-day fund when things are going well. It would be better to run up deficits doing things that people actually need, like creating jobs when the private sector is unable to, but it still helps as some kind of stimulus.

Which is fine, but running up trillions of dollars in debt does matter. It pushes up interest rates. Which is why you can't really claim that Clinton had nothing to do with the 90s upturn. When he made it clear that we would no longer have deficits as far as the eye can see and start having some fiscal discipline, that enabled Greenspan to start lowering interest rates. And that helped stimulate the economy and immediately made Wall Street sit up and take notice.

And believe me, if W continues to run giant deficits right into the 2010s, interest rates are going to climb back up.

The fact that the 90s economy turned into an unsustainable speculative bubble is more Greenspan's fault than Clinton's, though Bill was happy to take credit for it as long as the good times lasted. And I'm happy to give him some of the blame, either way. But there towards the end it actually did start to trickle down to working people, who saw their wages start to creep up from the flatline they'd been in since Nixon's second term.

But hey, when I mentioned the most prosperous decade in our history, I didn't mean the 90s; I meant the 50s!

Income distribution was as egalitarian as it's ever been. Rich people and corporations paid much higher taxes. Unionized workers had much better protection, and there was a huge thriving middle class. People could buy a house and stuff it full of appliances and raise four kids on one working guy's salary. The middle class was sustained by all sorts of programs like the GI bill and mortgage interest deductions, which were paid for by higher taxes on the very rich. Of course the boom owed a lot to the pent-up demand from the war years and the fact that all of our industrial rivals lay in ruins.

But the prosperity was not just an accident; it came from state intervention in the economy and years of struggle by working people. How we got from there to here is another story, but it also came from state intervention in the economy, and years of struggle by wealthy people. And old Dutch Reagan sure helped a lot. But at least, unlike the current chief executive, he had the sense to undo some of his mistakes.

No comments:

Post a Comment